10 Best Day Trading Tips For Traders

Day trading just a few hours each day can give you a lot of freedom, so compared to working a 9 to 5 job, you can have plenty of time to spend with your family, friends or doing the things you like the most.

For example, I prefer to trade the first three hours of London or New York market opens.

And there's no limit on how much you can make when you are great day trader and consistently profitable in day trading.

But there's a catch.

Even though the upside is huge, it requires skills, knowledge, patience, and consistency.

Trading is not a "get-rich-quick" thing.

Here are the 10 best day trading tips to become a great and more profitable day trader:

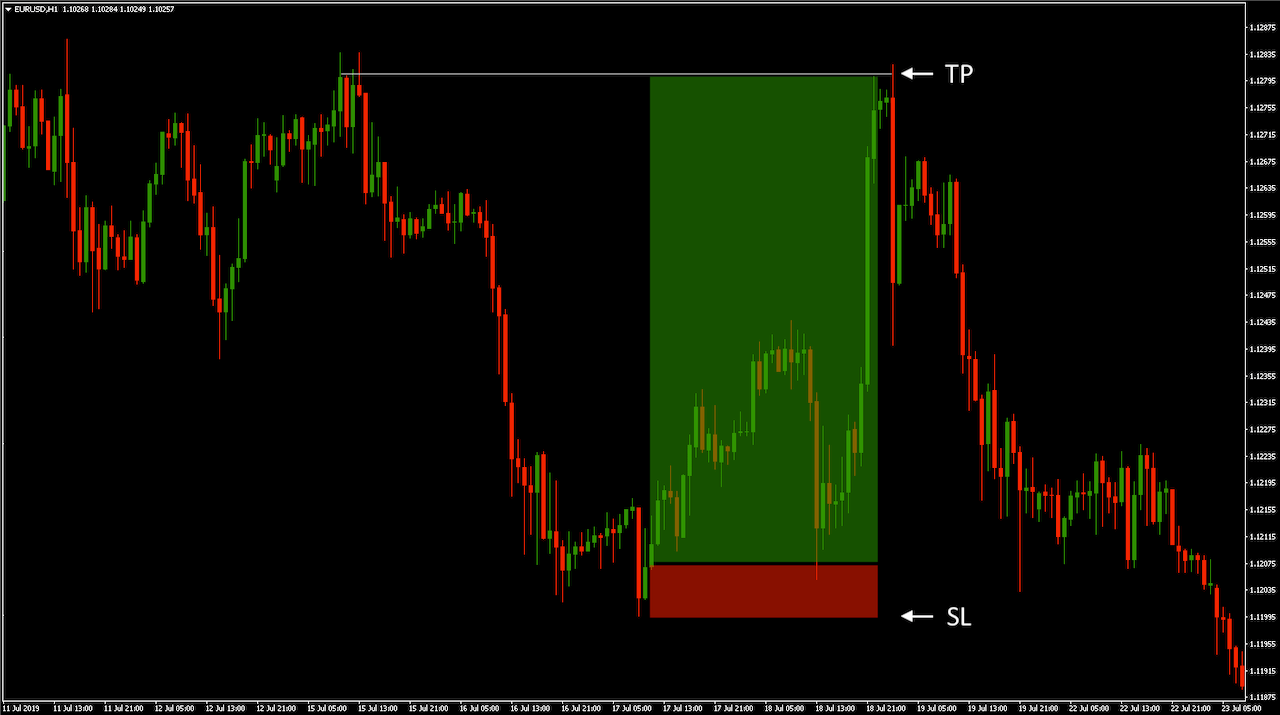

1. Set Stop Loss And Take Profit Target

It's normal as you start making some profits in a trade to want to secure the profit earlier than planned. This is going to be bad for your trading results in the long run.

You might take a trade because you anticipate a reversal.

Or you might take a breakout trade anticipating the continuation of the trend.

Whatever your position is, you have to set a take profit target (TP), where you close your position for a profit.

You also need to set a stop loss (SL), where you close your position for a loss if your trade doesn't work out.

Once you set your stop loss and take profit, stick to it, this way you will protect your trading account and avoid the mistake of being too greedy.

These trades are taken when trading the 10X Trading System (trading 10X signals at support and resistance levels will help you find 10+ risk reward ratio trades (why it's named 10X) when you get the hang of it).

Always set a stop loss and take profit target when you enter a trade.

2. Trade With Patience

One if the most important day trading tips for day traders, no matter if you are a beginner or an advanced trader, is trading with patience.

Trading is very risky if you trade on hunches and gut feelings, anything can happen, so you need to be able to stay patient when there are no trade setups and act fast with confidence when you get a trade setup.

The majority of people that quits day trading, are too greedy and lack patience, which leads them to rushing decisions and making big losses.

Can you sit on your hands a whole day waiting for your setups without taking any unnecessary actions?

Patiently wait and only take trade setups that follow your trading plan.

3. Know Technical Analysis

In day trading, is very important to know your technical analysis.

Among day traders, price action trading is king.

One of the most popular price action trading strategies/techniques is support and resistance trading.

Make sure you always look to buy (go long) at support levels and sell (go short) at resistance levels.

Here's how I find and trade hidden supply (resistance) and demand (support) levels:

Waiting for confirmation is rarely profitable in day trading, you need to be confident in your levels and trade them with no fear.

Day traders who wait for confirmation from (for example) a lagging moving average crossover will be late in the trade and their risk reward ratio will suffer. The moving average crossover can work for swing traders and investors, but rarely for day traders.

So trade proven day trading strategies and non-lagging signals based on price action.

4. Understand The Markets

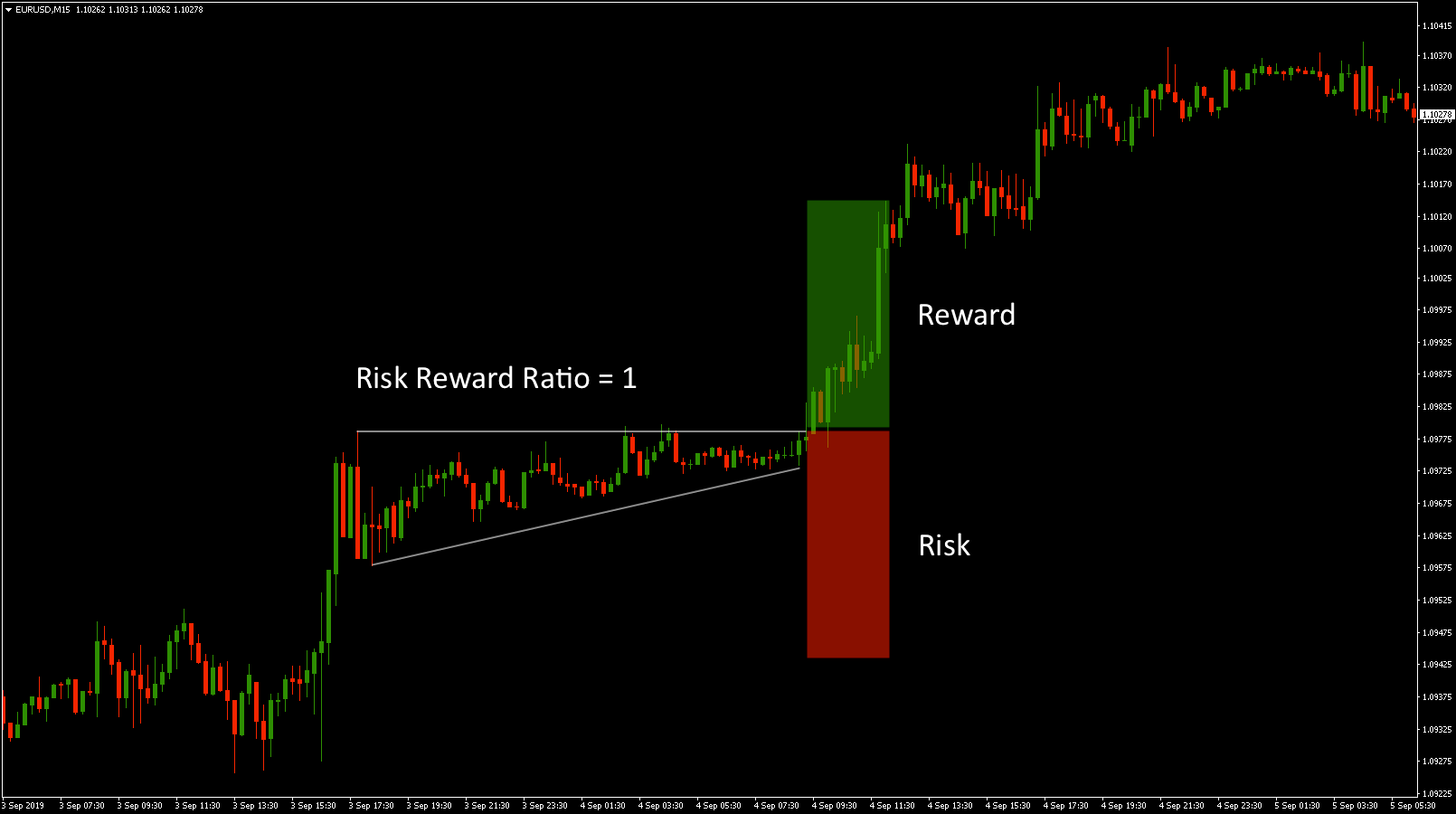

5. Master Risk Management

We all know that higher risk equals higher potential profit. So one of the essential topics all great day traders have mastered is risk management.

In day trading, you should have a Risk Reward Ratio (RRR) above 1 on every trade you take in order for you to always have a higher potential reward compared to your risk.

Here is an example of a trade with RRR below 1, a trade most successful traders would ignore. The setup for this trade breakout of a chart pattern.

Now same trade with RRR equal to 1, which is still not good enough for most traders.

Now let's look at the best option, RRR above 1 which, means you reward is greater than your risk.

As you become a better day trader you will learn how to better manage risk.

Nevertheless, I recommended (no matter how experienced you are) to always take small risks (1% risk per trade) and aim for higher rewards on every trade.

Only take trades with a Risk-Reward Ratio above 1.

6. Stay Consistent

One of the most important trading tips to become a great day trader and make consistent profits is, well, to be consistent.

By consistent I don’t mean to trade every single day, but to always stick to your plan, risk management, and most importantly control your mindset.

Unlike what the majority of people think, the best and most successful traders in the world don’t trade every single day.

The best traders are best because they wait for the best opportunities that follow their plan. They get consistent results because their trading is consistent.

More is not always better.

In day trading, it's not that important how many trades you make but if you follow your plan or not. Be disciplined and consistent in your trading.

7. Trade More Than One Strategy

Trading at least two strategies can be really helpful.

In case one of your strategies doesn’t give you setups, you can use the other one.

The more strategies you have the better (as long as you don't get confused and can't follow your plan).

If you trade too many strategies you will find it really hard to stick to your risk management because of all the open trades you might have in the market.

Like I said before, more is not always bette, especially for beginners.

Trade more than one strategy, but not more strategies than you can handle.

8. Invest In Education

9. Trade In The Zone

10. Start Small (Never Trade With Borrowed Money)

Enjoyed this Guide? Tweet It

CUSTOM JAVASCRIPT / HTML

Johan Nordstrom is a full-time trader, and a family guy in his early 30's who trades the markets in a simple yet effective way. He has a master's degree in risk management and years of experience trading the markets. He has helped hundreds of struggling traders become consistently profitable. Read more.

What To Read Next