Top 10 Best Traders In The World

The stories of the best and most successful traders in the world stories are fascinating.

And what are the rules they follow to make consistent profits trading the markets?

You will be amazed at how much your trading improves when you start practicing one, two, or all of these trading rules from these successful traders.

Many beginner traders come into trading because of the profitability, forgetting that trading involves high risk.

Without proper education, learning, and practicing, they dive in.

To successfully trade the markets and become the best trader you can be, you need to learn and follow successful trading rules and trade proven systems with an edge.

This is how the best traders in the game who have mastered market timing make consistent trading profits.

As the saying goes, "to be the best, you have to learn from the best."

These traders are not magicians. They grew in experience to the point where their gains far outweighed losses. But they do make losses sometimes, as any trader does.

The 10 Best And Most Successful Traders In The World

Like any other exchange market trader, stock traders and forex traders are risk-takers because of the volatility of the market.

All the profits you have made can flash before your eyes in split seconds, and they are gone if you don't manage risk.

You often hear from successful traders stories that risk management is the holy grail in trading. It's something all of these 10 successful traders below understand.

Here are the most successful and best trader in the world:

1. Jesse Livermore

Jesse Livermore is a legendary figure in the world of stock trading, known for both his impressive gains and devastating losses.

In 1929, Livermore made a staggering $100 million, making him the wealthiest and most successful stock trader of his time.

However, by 1934, he had lost all of his fortune and was forced to start over.

This dramatic rise and fall is a testament to the huge risks involved in stock trading and serves as a cautionary tale for aspiring traders.

Livermore's story is a reminder that even the most successful traders are not immune to the volatile and unpredictable nature of the markets.

Despite his losses, Livermore continued to trade and eventually made a comeback, but his experiences highlight the importance of risk management and the need to approach the markets with caution.

2. George Soros

George Soros is a household name in the world of finance and is widely regarded as one of history's best and most successful stock and richest forex traders.

He is perhaps most famous for his risky bet against the British pound in 1992, which earned him the nickname "the man who broke the Bank of England."

On September 16, 1992, Soros placed a massive bet against the pound, selling $10 billion worth of the currency.

At the time, the pound was being propped up by the Bank of England as part of the European Exchange Rate Mechanism (ERM).

However, Soros believed that the currency was overvalued and that the Bank of England would not be able to sustain its support.

As it turned out, Soros was right. On September 16, the Bank of England abandoned its support for the pound, and the currency crashed.

Soros's bet paid off in a big way, netting him a profit of $1 billion in a single day.

3. Richard Dennis

4. Paul Tudor Jones

Paul Tudor Jones is a highly successful trader and hedge fund manager who is best known for his impressive profits during the market crash of 1987. On October 19, 1987, known as "Black Monday," the stock market experienced a dramatic drop, with the Dow Jones Industrial Average falling more than 22%.

Jones, who was then running his own hedge fund, Tudor Investment Corporation, saw an opportunity to profit from the market turmoil. He had a strong conviction that the market was overvalued and that a crash was imminent, and he decided to bet against the market by shorting stocks. His bet paid off in a big way, netting him a profit of around $100 million in a single day.

Jones's success during the market crash of 1987 helped to cement his reputation as a savvy and successful trader, and he has continued to achieve impressive returns over the course of his career making him one of the best traders in the world.

5. William Delbert Gann

William Delbert Gann, also known as W.D. Gann, was a successful trader and market analyst who is known for developing a number of technical indicators that are still widely used today. Gann was born in 1878 in Lufkin, Texas, and began his trading career at the age of 21. Over the course of his career, he developed a number of innovative techniques for forecasting market movements and identifying trends.

Gann is perhaps best known for his development of Gann Angles, which are graphical tools that use geometric angles to identify trends and predict price movements. He is also credited with developing the Square of 9, a mathematical tool that uses the principles of geometry and numerology to forecast market movements.

Gann was a strong believer in the power of astrology and other esoteric disciplines to inform market analysis and forecasting, and he often incorporated these principles into his trading methods. Despite his unconventional approach, Gann was widely respected in the trading community and is considered one of the pioneers of technical analysis. His work has influenced many traders and analysts over the years, and his techniques continue to be widely studied and used today.

6. Bill Lipschutz

7. John R. Taylor Jr

John R. Taylor Jr is a top trader in the world of forex trading and is the owner of FX Concepts, a successful currency management firm. Taylor's career in the financial industry began as a political analyst for Chemical Bank, where he worked in the bank's research department.

While working at Chemical Bank, Taylor became interested in the forex market and eventually transitioned into a role as the bank's forex analyst. In this role, he was responsible for analyzing currency markets and providing insights and recommendations to the bank's traders and clients.

In 1981, Taylor founded FX Concepts, a currency management firm that provides a range of services to clients, including currency overlay, risk management, and trading strategies. Under Taylor's leadership, FX Concepts has grown into one of the largest and most successful currency management firms in the world.

8. Stanley Druckenmiller

Stanley Druckenmiller is one of best traders in the world who is known for his impressive returns in both the stock and forex markets. Druckenmiller began his career as an oil analyst for the Pittsburgh National Bank, where he gained experience and insights into the financial markets.

In 1988, Druckenmiller left the Pittsburgh National Bank to join Soros Fund Management, a hedge fund founded by George Soros. While working at Soros Fund Management, Druckenmiller played a key role in a famous trade that netted the firm a profit of around $1 billion. The trade, which involved betting against the British pound, is widely considered to be one of the most successful in history.

After his success at Soros Fund Management, Druckenmiller went on to found his own hedge fund, Duquesne Capital Management. Under his leadership, the fund achieved impressive returns and became one of the most successful in the world.

9. Andrew Krieger

Andrew Krieger is a successful trader who is widely regarded as one of the best forex traders in the world. Throughout his career, Krieger has made a number of impressive trades that have earned him significant profits. Perhaps his most famous trade came in 1987, when he sold the New Zealand currency, known as the kiwi, in a move that would come to be known as "the kiwi short."

At the time, Krieger was working as a currency trader for Bankers Trust, and he saw an opportunity to profit from what he believed was an overvalued kiwi. He decided to bet against the currency by shorting it, and his bet paid off in a big way. The trade was valued at more than the total currency supply of New Zealand and earned Krieger a profit of around $300 million.

Krieger's success in the kiwi short made him a legend in the trading community and cemented his reputation as one of the best and most successful traders in the world.

10. Michael Marcus

Michael Marcus is a successful forex trader regarded as one of the best in the world. Throughout his career, Marcus has achieved impressive returns in the forex market and has earned a reputation as a skilled and successful trader.

Marcus's success in the forex market can be attributed in part to his training under Ed Seykota, a legendary trader and mentor who is known for his pioneering work in technical analysis and trading systems development. Seykota took Marcus under his wing and taught him the principles of successful trading, which Marcus has applied throughout his career.

One of Marcus's most notable trades took place during the presidency of Ronald Reagan, when he held positions in German marks worth almost $300 million. Marcus's trade was successful, and he was able to achieve impressive profits from his position in the currency.

Top 10 Rules Follower By Most Of The Best Traders

1. Trade A Trading Strategy That Suits You

This one is important. To be a successful trader, you must trade successful trading strategies.

For example – if you:

- Like swing trading – learn and trade a swing trading strategy

- Like trading reversals – learn and trade a tops and bottoms trading strategy

- Like to scalp or trade binary – trade a strategy that works on lower time frames

2. Analyze Price Charts

One trading rule that most successful traders share is analyzing price charts to find the best entry and exit points.

Even if they analyze fundamentals, they almost always look at price charts for timing trades.

Learning how to read candlestick charts is an essential skill for traders.

You can get started with free charting software to practice and develop your chart reading skills.

Whether you’re a beginner or already have some experience as a trader, start analyzing the longer-term charts, like the weekly and daily charts.

That will help you find the most significant price moves to trade successfully.

“Most of the time trailing stops are more profitable than profit targets. We need the big wins to pay for the losing trades. Trends tend to go farther than anyone anticipates.” – Unknown

3. Take Complete Responsibility

4. Learn From Every Trade

I know many traders who can't figure out why they don't make the returns they know they can have.

I've tried to explain to them that they need to track what they are doing to identify trading mistakes and avoid making them again.

Without a trading journal where you track your trades, it's hard to remember what made you act in a certain way at the time.

The best traders in the world track their trades. That enables them to learn from every trade and thereby advance their skills as traders.

And when you advance your skills as a trader, you make more money.

Tracking your trading does not have to be complicated.

For example:

Take a screenshot of your chart, use an Excel document or pen and paper to write down the security, date, price, stop price, setup, and thoughts behind the trade.

When you close your position, you write down the date and price if you followed your rules, gain/loss, and thoughts about the trade.

Simple as that!

“A peak performance trader is totally committed to being the best and doing whatever it takes to be the best. He feels totally responsible for whatever happens and thus can learn from mistakes. These people typically have a working business plan for trading because they treat trading as a business.” – Van K. Tharp

5. Successful Trading Is Part Of A Balanced Life

Success is so much more than being a profitable trader.

You can't neglect:

- Health

-

Wealth

-

Family

-

Love

-

Lifestyle

-

Spirituality

The best traders in the world keep a balance between these.

They understand that focusing on only trading does not equal success.

But maintaining balance is not easy.

There are times when your focus is on other areas, and trading is neglected.

That's part of your life's journey.

A happy family, healthy body, and relaxing hobbies will help you and stay emotionally disciplined.

So to become the best trader you can be, make trading part of a balanced life.

“The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading.” – Victor Sperandeo

6. Never Lose Courage

The scarier the trade is to take, the better is most often is.

That is why professional traders have developed courage in themselves and their trading plan.

You need to trade with no fear of trading to become a successful trader.

Always follow your trading plan and rules. No matter what you hear on the news, friends say, etc.

'"The time to buy when there is blood in the streets." – Baron Rothschild

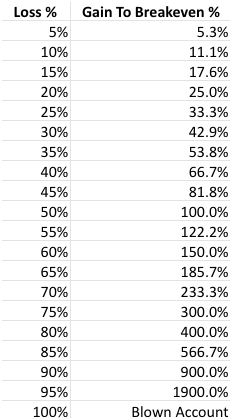

7. Don't Dig Yourself Into A Hole

If I had to pick a number one rule in trading, this is certainly a candidate.

Before you open a trade, always predetermine your max loss for the trade.

If you don't, you are likely to hold onto losing positions, hoping they will reverse.

Hoping will only result in significant losses over the long run.

For example:

If you have a 50% loss on your account, a 50% gain will not result in you becoming breakeven.

If you have a 50% loss on your account, you need a 100% gain to breakeven.

And it's not fun if you have to spend days, months, or years digging yourself out of a hole you got yourself into in the early days of trading.

Start slow, observe, and practice on a demo account.

So how do you avoid digging yourself into a hole?

Follow a risk management strategy.

“I’m always thinking about losing money as opposed to making money. Don’t focus on making money, focus on protecting what you have” – Paul Tudor Jones

8. If You Think You Are Wrong, Get Out

This rule is, for some reason, easily forgotten or ignored.

You can't be right with your market timing all the time.

If you are wrong, get out.

Listen to that little voice in your head, telling you that you are wrong.

I have heard traders say:

"I know I am wrong" – as they continue to hold on to their position and lose more money.

Most often, they've not accepted the fact that losses will happen.

Meanwhile, new setups with high probability occur continuously.

At the sign of being wrong when your trade reach your stop loss level, get out.

Then look to open a new trade in a setup with a higher probability than your losing position.

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.” – Ed Seykota

9. Wait For Your Setup To Play Out

Successful traders never "jump the gun."

For example:

– Never close profits early (wait for your take profit target).

– Never chase the market (if you missed a setup, wait for the next one).

Traders who "jump the gun" most often lose a lot of money.

Exercise patience when you're waiting for your trade setups to plays out.

Bear in mind that a successful trader can be compared to a lion, an amazing predator due to its great stalking skills, and a patient one at that, always waiting for the perfect opportunity to go for the kill and what's more when he goes for it he rarely misses.

"Money is made by sitting, not trading." – Jesse Livermore

10. Follow A Trading Plan

Johan Nordstrom is a full-time trader, and a family guy in his early 30's who trades the markets in a simple yet effective way. He has a master's degree in risk management and years of experience trading the markets. He has helped hundreds of struggling traders become consistently profitable. Read more.

What To Read Next