Top 10 Most Common Trading Mistakes

Most traders make mistakes.

But what can you do to avoid some of the most common trading mistakes?

The best way to avoid mistakes is to set trading rules that help you avoid them, and if you have the discipline to stick to your trading rules, you'll be on your way to successful and profitable trading.

Here are the 10 most common trading mistakes and how to avoid them.

1. Not Having A Trading Plan

If you have a trading plan, you will always know when and how to trade the market.

You will know with confidence where to place your trades, take your profits, and cut your losses.

Your trading plan primarily consists of one or more trading strategies and trading rules.

Why is this important?

Having a trading plan makes trading easy, and it takes out the thrill, anxiety, and complexity of trading.

When you don't have a trading plan and trade on hunches, you'll more likely want to try a new strategy as soon as the one you're currently trading "stops" working.

Most beginner traders will usually jump from one strategy to another every other week.

You'll be a jack of all trades but master of none.

Suppose you continuously jump from one strategy to another in the hope of finding the Holy Grail.

In that case, you are running on false hopes.

As a result of this endless jumping around, you'll continue to lose money and then give up.

You need a proven plan and discipline if you want to become a successful trader.

2. Not Following The Trading Plan

For your trading plan to be of any use, you have to follow it.

Never deviate from your plan.

Most beginner traders want to trade multiple strategies all at once.

They have this thinking that it will help them make more money from trading.

However, the most successful traders only use a few trading strategies.

It's essential to be patient and master one strategy at a time.

And focus on the process of following your trading plan and rules as well as possible.

That will help you make the best trades, which will result in your account growing.

Once you mastered one strategy, you can move on and implement other trading strategies.

3. Impatience

Everything starts with patience.

As a trader, you need to have the ability to sit and do nothing.

Take your time to practice new strategies and trading habits by demo trading on one of these broker platforms.

Making the mistakes demo trading will allow you to stay in the game.

If you desire to trade on a live account immediately, do it with a small amount of money.

If you risk too much, one trade can wipe you out and stop you from trading.

To try to make back losses by revenge trading.

That's emotional trading.

And it's one of those worst things that a trader can do because it often makes you lose more money.

So I recommend that you set a maximum loss per day. If you get to your max loss per day, you should stop trading for the rest of the day to protect your trading account.

4. Overtrading

Overtrading goes hand in hand with impatience.

If you don't have a setup, do not trade.

Don't makeup trades just because you have a trigger finger.

Wait for the setups you have in your trading plan, and then trade those setups without hesitation.

Overtrading can also be that you exit your positions too soon before reaching your take profit target.

"But I heard you can never go broke taking profits?"

Here's the truth:

If you don't have the patience to let your profits run according to your plan.

Then, you're not following your plan.

If you take profits early, your losses might end up larger than your profits. That's a bad risk reward ratio.

So, be patient when you are in a trade, and let your trade reach your take profit target.

5. Emotional Trading

It would be best if you had an emotion-free mind when trading.

You always see opportunities in the market, objectively analyze every situation no matter if you are in a losing or profitable trade, and take responsibility for all your decisions and trades.

But there's a catch.

Humans are emotional beings. So the best you can do is be as emotion-free as possible.

I highly recommend you read Trading In The Zone by Mark Douglas.

It's one of the best trading books to learn more about trading psychology and mindset.

Most beginner traders feel fear of trading at the first sign of a trade moving against them.

They freeze and let losses run in the hope it will reverse.

You'll only see this in live trading because there's emotional pressure when you're dealing with real money compared to when you trade with paper money on a demo trading account.

On demo accounts, everyone is a successful trader.

Why?

It's because there's no emotional pressure.

This emotional reaction of fear is something that you must learn to address if you want to become a successful trader.

You need to overcome the fear of trading because trades will move against you.

And because these trades can reverse and become good profits, you must let your trades play out.

6. Risking Too Much

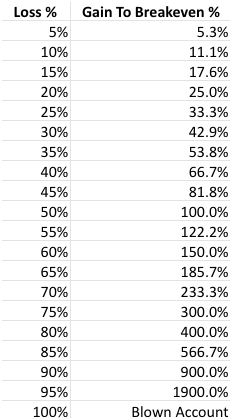

You can never know the outcome of a trade in advance, no matter how good it looks. Every trade is unique. Therefore, only risk a specific amount of your capital on your trading account on each trade.

Risk management is essential in trading.

Here's the deal:

Some aggressive traders might use 5%.

But most successful traders never risk more than 1% loss per trade.

By adopting this 1% rule, even if you have a bad day or week, you'll live to trade another day.

If you manage risk correctly, the gain you need to breakeven will not be that significant:

For example:

Suppose you are unfortunate or don't follow your trading rules.

In that case, you can have an extended drawdown and experience a loss sequence of 10 losses.

Based on probabilities, that can happen even if you have an ok winning percentage of around 70%.

Depending on how much you risk each trade, the drawdown will look very different. Only those who risk 1% per trade will survive this type of drawdown that can happen during black swan events.

7. Giving Up

Don't be afraid of making trading mistakes. Mistakes are proof that you are trying.

We all make mistakes, make exceptions to rules, and sometimes take losses we regret.

The difference between losing and profitable traders is how we see setbacks.

Losing traders see setbacks as someone else fault (the market, broker, weather, etc.), anything they can think of but themselves.

Profitable traders know that the best strategy is knowing themselves, and there are lessons we can learn from the setback.

That's why journaling and reviewing your trading is crucial if you want to become a better trader.

You often find your best learning lessons on how to improve from your losses.

Therefore, journaling every trade and reviewing them is something you should start doing today.

And keep trading.

8. Not Letting Profits Run

A profitable trading strategy can become unprofitable if you take your profits too early.

You might see a good profit on your trade, but then it starts moving against you, so you close it out early.

Don't do that.

If you follow a proven strategy, there's a high probability that it's just a minor pullback before the price continues to move to your take profit target.

The best way to deal with this problem is to enter a stop loss and profit target when you take the trade and then walk away from your computer.

Let the trade work for you.

You can also use a trailing stop loss to let your profit run more after reaching your take profit target.

The technique I talk about in this video will give you profitable risk reward ratio trades:

Trailing Stop Loss Technique (2:00)

9. Not Cutting Losses

Losing trades should only ride to your stop where you close the trade.

Moving your stop when you are in a trade is a devastating and losing habit.

A trade should end in one of four ways:

1. A big win

2. A small win

3. Break even

4. A small loss

You should never experience a big loss.

So cut your losses at your decided stop loss level and never let them turn into big losses.

But that's not all.

You can't cut your losses too early (before your stop loss level), either.

Beginner traders will usually lose huge amounts of money because they never let their trades play out.

Suppose you cut your losses too early or moving your stop loss closer to your entry when you are in a losing position (overtrading).

In that case, you will close out for losses even before the market had the chance to turn into your favor.

Place your stop losses and take profit, so you get a good risk-reward ratio. Also, knowing you might need to give the trade some space to play out.

10. Not Keeping It Simple

A big mistake many traders make is trading a strategy too complicated for them to trade.

You want to keep it simple.

Most beginner traders usually make trading too complicated.

They are a jack of all trades but master of none.

So how can you keep it simple?

Think quality over quantity.

For example:

Master one strategy, stick to one or two time frames (for multiple time frame analysis), and trade one market.

Take trades in the direction of the trend on a daily chart and use an intraday chart to confirm entry. So if the daily chart shows an uptrend, wait for the intraday chart to confirm that with a bullish trading signal.

Johan Nordstrom is a full-time trader, and a family guy in his early 30's who trades the markets in a simple yet effective way. He has a master's degree in risk management and years of experience trading the markets. He has helped hundreds of struggling traders become consistently profitable. Read more.

What To Read Next