Risk Management And Best Risk Reward Ratio For Trading

In trading, one of the essential topics you need to understand is risk management.

It doesn't matter if you do swing trading, day trading, scalping, or binary trading – risk management is critical.

That's something the all of the best traders in the world understand.

In this guide, I will explain how to control risk and the importance of a good risk reward ratio.

Most traders stop trading because they make significant losses. So if you want to become a successful trader, you need to focus on doing what you can to reduce the size of your losses when they happen.

When trading on a margin account, you can quickly lose all your money if a trade goes against you, and your position size is too big for your account.

Simultaneously, you also need to optimize your trade size to make the biggest possible profit according to your risk preference on each trade.

By knowing how to manage risks, you can play the long game and start making consistent profits.

Position Size Calculator

CUSTOM JAVASCRIPT / HTML

Why Is Risk Management Important?

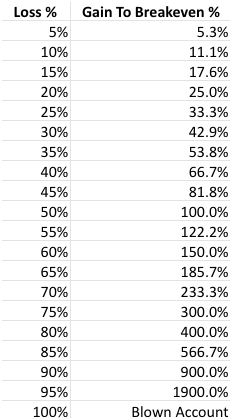

Risk management is important because if you don't manage your risk, you will most likely lose a significant portion of your trading account. The percentage gain you have to make back to breakeven increases exponentially the more you lose.

Don't dig yourself into a hole.

5 Risk Management Quotes

“Don’t focus on making money; focus on protecting what you have.” – Paul Tudor Jones

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“When I get hurt in the market, I get the hell out. It doesn’t matter at all where the market is trading. I just get out, because I believe that once you’re hurt in the market, your decisions are going to be far less objective than they are when you’re doing well… If you stick around when the market is severely against you, sooner or later they are going to carry you out.” – Randy McKay

“Frankly, I don’t see markets; I see risks, rewards, and money.”- Larry Hite

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.” – Ed Seykota

Risk Management Basics

Anything can happen in the markets.

And anything can affect the price of a stock, forex pair, or commodity negatively or positively.

Instead of "going all in" (most often results in blown accounts) as most beginners do, it's better to manage your risk because if you lose, you will still be able to take the next trade.

"Going all in" is a common mistake, especially amongst beginner traders just starting to trade.

The two most important rules of risk management are:

1. You should never risk more than you can afford to lose.

2. You should always trade with a good Risk Reward Ratio (RRR).

What Is Risk Reward Ratio RRR?

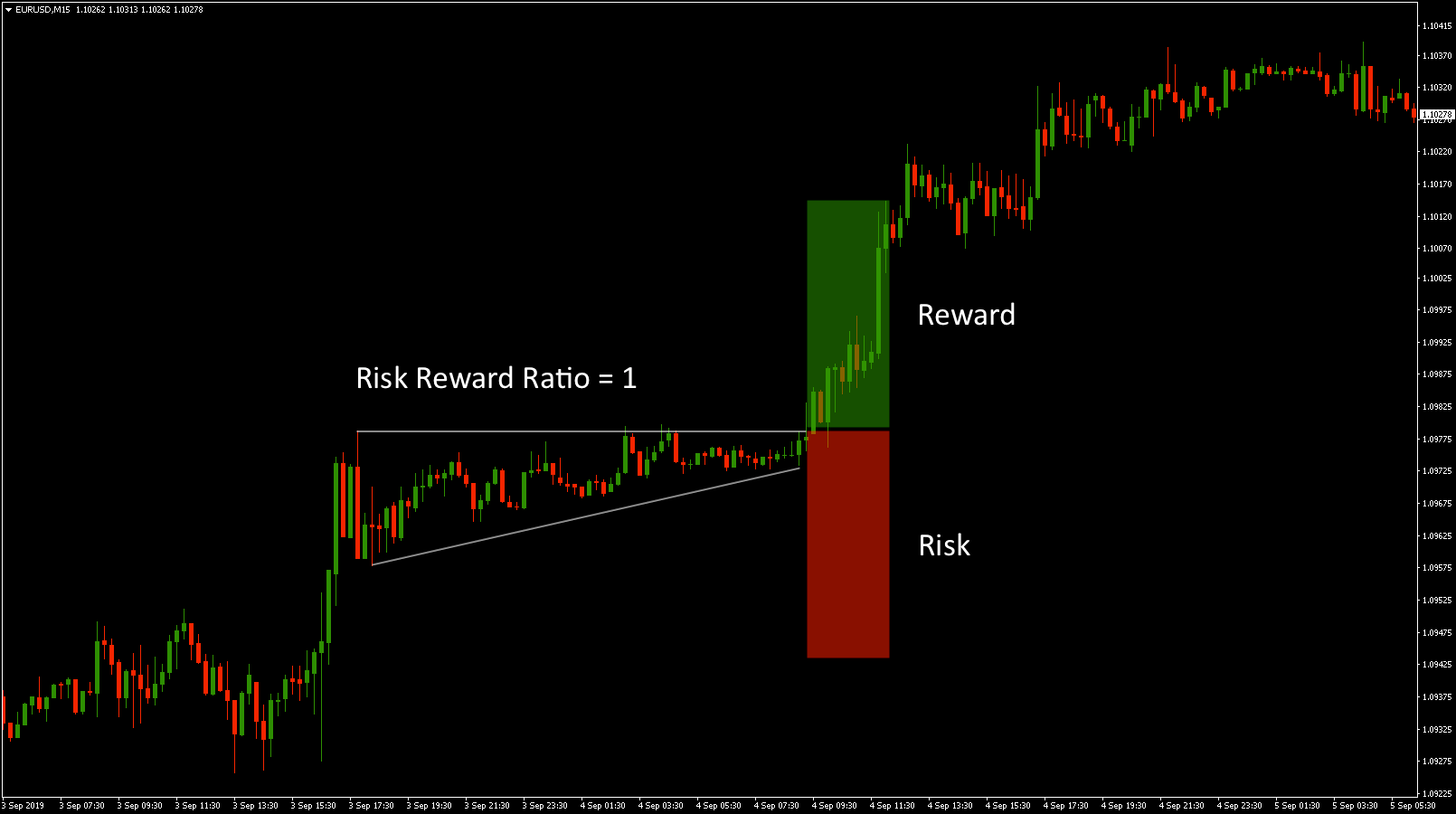

Your risk reward ratio is how much you risk per trade, relative to how much you expect to make (reward).

When trading, you should always aim for a bigger reward compared to your risk per trade.

Let's look at an example...

A good rule is only to risk 1% per trade (the 1% rule).

Following this rule means you will not risk losing more than 1% of your account value on a single trade.

A common misunderstanding is thinking you can only use 1% of your account to trade. The 1% rule does not mean that if you have a $10,000 trading account, that you can only take a $100 position, which is 1% of $10,000. The truth is that you can use all of your capital on a single trade or even more if you utilize leverage (if done correctly).

Best Risk Reward Ratio For Trading

One of many key trading tips is to always trade with a risk reward ratio above 1.

Here is an example of a trade with RRR below 1, a trade most pro traders would ignore.

We recommend you use a technical analysis charting software to easily analyze risk reward ratio.

Here is an example of a trade with RRR equal to 1, which is still not good enough for most pro traders.

Here is an example of the best trade, RRR above 1, which means your reward is greater than your risk.

The best risk reward ratio for you depends on your trading style, but you never want a risk reward ratio below 1. If you swing trade, a good risk reward ratio is 3, 4, 5, or even 10 which is what I aim for when I trade the 10X Trading System. But if you scalp, a good risk reward ratio is 1 or 2 (because you are more focused on quantity).

Trade Your Way To Financial Freedom by Van K. Tharp is the best trading book for more about risk.

The main rule here is that you never want to enter a trade with a risk reward ratio less than 1 (that means you lose more if the trade hit your stop-loss than you would make if the trade hit your take profit).

A risk reward ratio at 1 allows you to be breakeven even if you lose 50% of your trades. A risk reward ratio above 1 allows you to be profitable even if you lose more than half of your trades. That means that if you have a risk reward above 1 and win rate above 50% you will be profitable.

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

Calculating Risk Reward Ratio RRR

Using the 1% risk rule, I mean that you apply risk management to avoid losing more than 1% of your trading account value on a single trade.

So if you lose a trade with your $10,000 trading account, your account value will be $9,900.

In trading, it's impossible to win every trade, and the 1% risk rule helps protect your trading account when you lose. If you risk 1 percent of your trading account on each trade, it doesn't hurt you to lose five trades in a row.

If more beginner traders followed the 1% rule, many more would be successful in their first year trading.

Risking 1% per trade may seem like a small amount to some people, but trading with a high risk reward ratio can still provide great returns.

If you risk 1%, you should preferably set your take profit to 2% or more.

Risk reward ratio 2/1 = 2.

When swing or day trading, gaining a few percentage points on your account each day or week is possible when using this simple rule, even if you only win half of your trades.

How To Manage Risk In Trading

In addition to the 1% rule, what can you do to manage risk in trading?

First, make sure you follow a proven trading strategy and trading plan. It should include entry, take profit, and stop-loss rules to easily calculate your risk reward ratio.

Your trading strategy and trading plan should be easy to follow. Think step by step process. Keeping it simple and step by step helps you avoid common trading mistakes that often lead to significant losses.

Focusing on quality (higher probability trades) over quantity also helps you manage risk in trading.

High Risk Reward Ratio Trading Strategy

Taking an entry on the reversal signal and trailing your stop-loss using the exponential moving average 8, is a very good strategy to maximize your risk reward ratio.

How To Grow A Small Trading Account

The easiest way to grow your small trading account is to stay consistent and don't lose money. Seriously, when you are a beginner and learning how to trade, your focus should be on taking small losses and avoiding big drawdowns.

Keep in mind.

These methods apply to big trading accounts as well.

Following a proven strategy, the 1% rule, and trading with a good risk reward ratio will help you make 20%+ returns easily when you learned these steps.

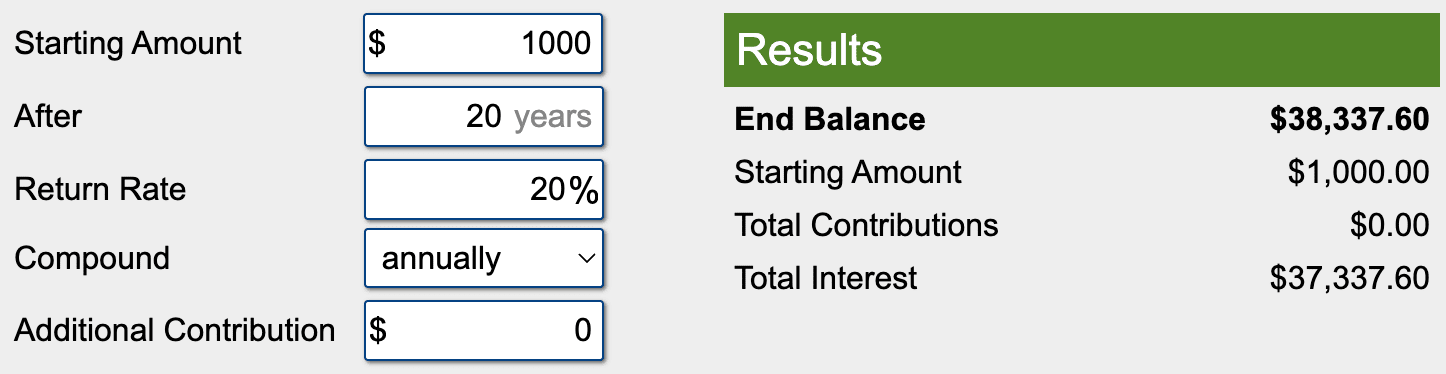

Easiest Way To Grow A Trading Account

The easiest way to grow your account is to add an additional contribution to your trading account each month. Just adding $100 each month adds up quickly.

The power of consistency and compounding.

Your end balance will be almost ten times the account size without an additional contribution each month of just $100.

Fastest Way To Grow A Trading Account

This is how you grow your trading account. Doesn't matter if you have a $100 account or a $100,000 account, you should still follow these methods.

Common Risk Management Mistakes

The fundamental rule in trading is not to risk more than you can afford to lose. Risking too much on each trade is one of the most common risk management mistakes.

That goes hand in hand with the mistake of not calculating the correct position size to ensure each trade's risk is 1%. You can use an online calculator to calculate the right position size. Enter your account size, risk per trade (1%), entry price level, stop-loss price level, and take profit price level.

It doesn't matter if you think the setup you see looks like a sure thing. Anything can happen in the markets. The market can be affected by just about anything – news, natural disasters, elections, rumors, etc. And to make things worse, the market sometimes reacts in a completely different way to news than expected.

Therefore, you must understand risk management and calculate your risk before taking a trade if you want to become a consistently profitable trader.

Johan Nordstrom is a full-time trader, and a family guy in his early 30's who trades the markets in a simple yet effective way. He has a master's degree in risk management and years of experience trading the markets. He has helped hundreds of struggling traders become consistently profitable. Read more.

What To Read Next